Lagos State consistently generates the highest IGR of any state in Nigeria. Taxes are the major source of this revenue, accounting for over 80% of total IGR. We explore how and why Lagos’ tax-driven IGR model works and what other states can learn.

Lagos State Vs Obasanjo

In 2004, after the governor of Lagos State, now president, Bola Tinubu, created 37 new LGAs, President Obasanjo unilaterally withheld federal allocations to Lagos State.

This confrontation with the federal government, followed by another protracted Supreme Court battle over VAT revenues between 2005 and 2010, galvanised Lagos to establish a robust system of internally generated revenue. The adversity from these federal feuds played a huge role in pushing Lagos to innovate in revenue collection.

Exploiting Its Demographic Potential

With a population of about 22 million, what was once seen as a liability, crowded slums and traffic jams, has become a formidable asset. The sheer volume of people means a vast taxpayer base. Moreover, Lagos’s strategic coastal location has turned it into West Africa’s premier trade hub, allowing to attract businesses from around the world.

These are potentials not sources of income themselves. Property taxes, like the Land Use Charge (LUC), an annual tax on real property, generate billions of naira each year. Business levies collected from over 4,000 multinationals and various user fees, from tollgates on the Lekki-Epe Expressway to parking fees and market permits, complement the revenue base.

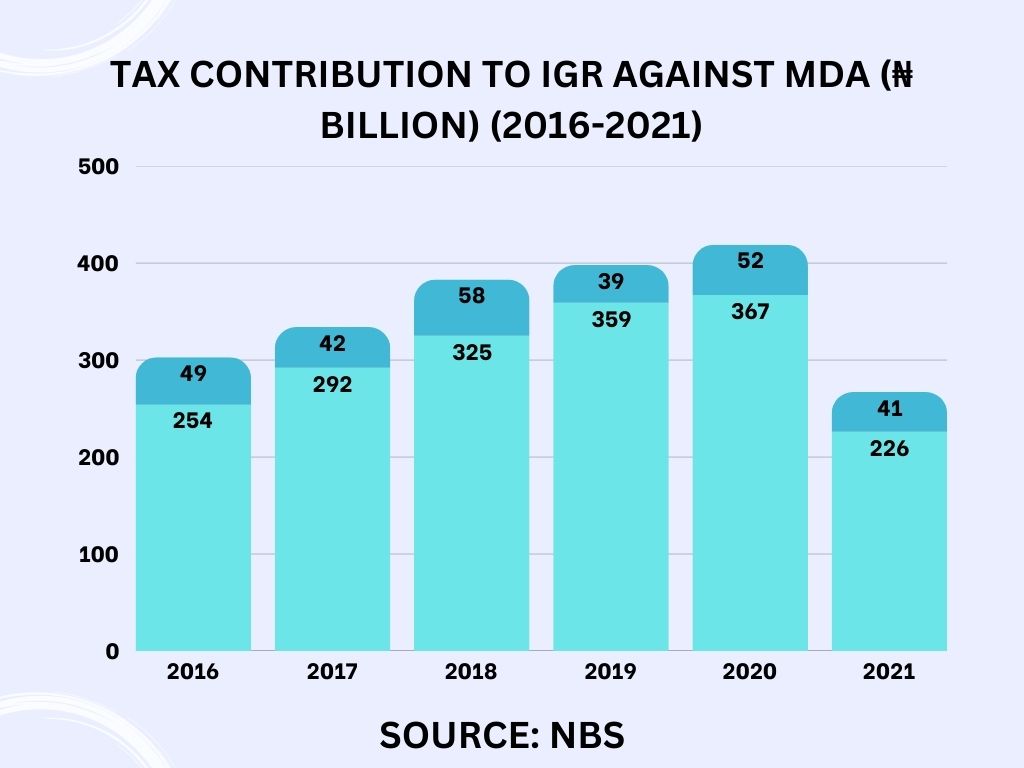

However, the bulk of Lagos State IGR comes from from personal income tax. Between 2016-2021, PAYE accounted for 63% of Lagos State’s IGR. This allows it to exploit its large population.

Embracing Technology

A cornerstone of Lagos’s success is its tax collection system. In 2019, the state revealed that of its 4.8M registered taxpayers, only about 700,000 were compliant. In September of the same year, it launched the ETax portal.

Created for ease of compliance, the platform spared people from having to remember payment references and codes and visiting designated banks. Taxpayers could file tax returns online, get their receipts, and access an online calculator to assess taxes directly.

Strict enforcement measures, in spite of the criticisms, ensure that businesses and individuals who fail to comply face serious consequences. This blend of technology and strict accountability has transformed what was once a chaotic system into a model of efficiency.

Transforming the Business Ecosystem

Lagos’s commitment to creating an environment conducive to business has also been instrumental in its IGR success. These policies has helped it attract significant investments, including major projects like the Dangote Refinery and the Lekki Free Trade Zone.

Even the informal sector, including motorcycle riders and street vendors, contributes levies that add up to 38-40% of VAT. This inclusive approach, where every segment of the economy is tapped for potential revenue, has not only diversified the tax base but also spurred economic growth.

A Lesson for Other States

Owing to gaps in enforcement and low levels of trust in government, among other things, the compliance rate for PAYE is still at just a paltry 16%. This shows that despite its stellar IGR performance, Lagos State has barely begun to fully exploit its IGR potential. With its goal of reaching ₦5 trillion in IGR, a clear model exists, needing only better implementation.

The Lagos IGR model demonstrates that with bold policies, technological adoption and relentless enforcement, self-reliance in revenue generation is achievable. Other states can learn from Lagos by embracing digital tax systems, formalising informal sectors and reducing their over-reliance on federal allocations.

The Lagos blueprint says that governments should tax smarter, not just harder.

Join Taxpal today to simplify your tax filings and help build a stronger Nigeria through responsible taxation.