Tax Identification Number popularly called TIN is a unique number issued by the Federal Inland Revenue Service, the federal tax authority in Nigeria.

The primary purpose of the TIN is for identification of taxpayers in Nigeria, either as an individual or an organization.

One of the most popular places where having a Tax Identification Number (TIN) is pivotal in Nigeria is at the point of opening a business or corporate account with any bank.

But the usefulness of having a valid TIN is more than just for opening a business account, it also prevents you from being taxed multiple times and is an important element in tracking your tax records.

You can generate a Tax Identification Number (TIN) as an individual or an organization. The process for each is quite similar but the requirements differ.

Getting your Tax Identification Number is free, and you can accomplish it online easily by following the steps listed below:

As an individual:

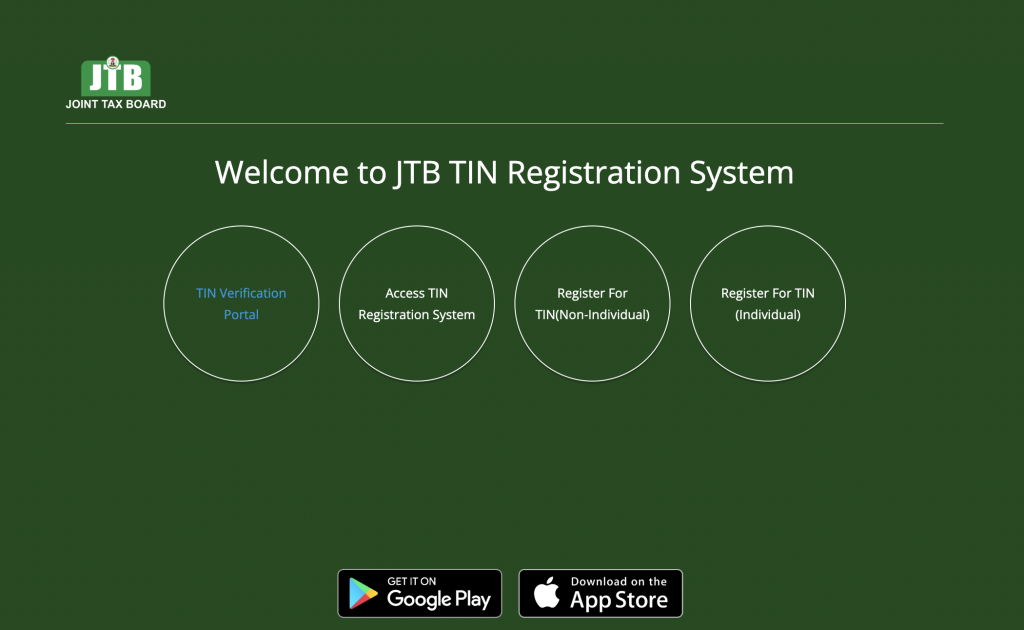

- Visit the Joint Tax Board website here

- Click on “Register for TIN (Individual)”

- You will be asked to provide your BVN and a valid means of identification

- Follow the simple process after providing the information

As an organization:

- Visit the Joint Tax Board website here

- Click on “Register for TIN (Non Individual)”

- You will be asked to select your organisation type, provide your business name and registration number

- Follow the simple process after providing the information

After completing this process, your application will be approved, and you will be issued a Tax Identification Number (TIN).

You can also verify your TIN here.

If you encounter any difficulties during the online application process or require expert guidance on tax-related matters, you can schedule a free consultation with Taxpal. Our experienced professionals are more than happy to assist you.”